Real-time intelligence for modern crypto teams

Monitor markets, track portfolio risk, and coordinate execution from a single command center built for institutional performance.

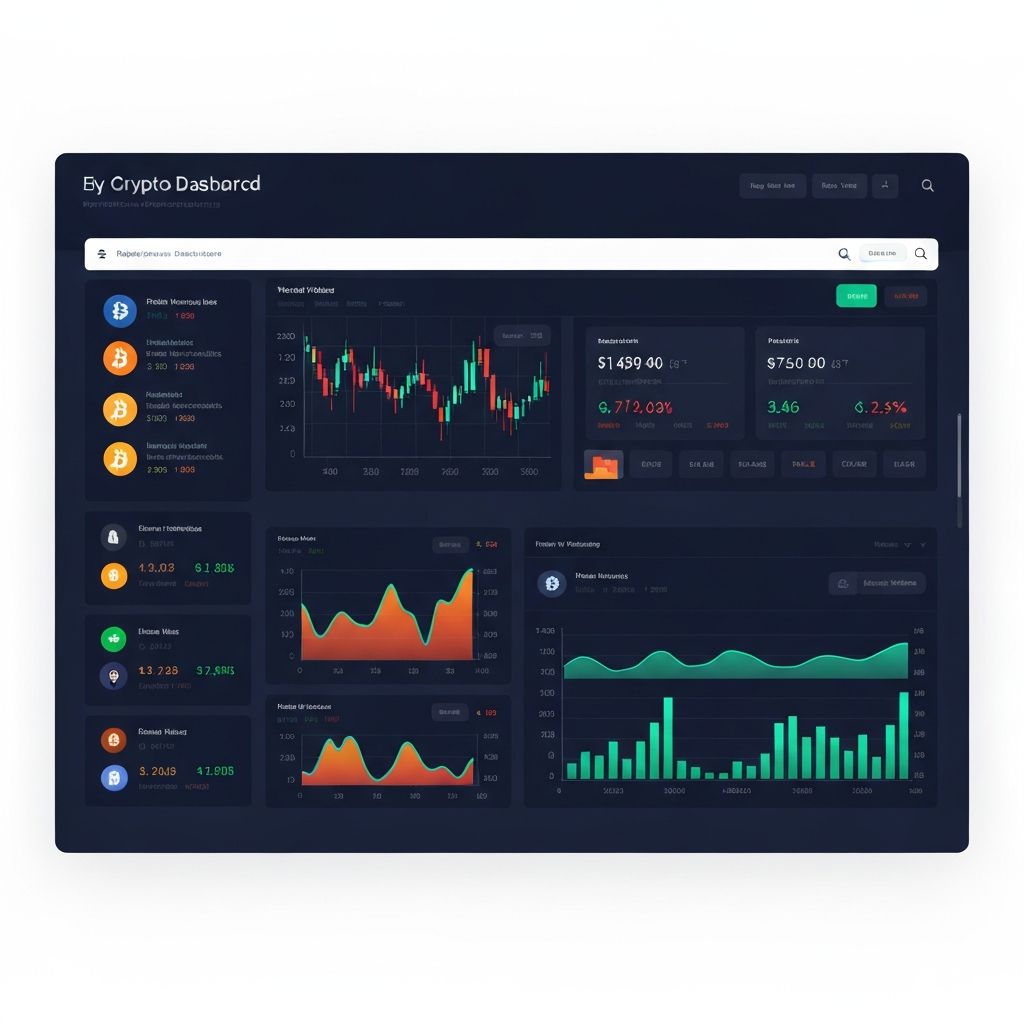

Global Markets

240+

Signals / Day

18,500

Avg. Latency

180ms

Coverage Assets

6,300+

Portfolio Value

$82.4M

+3.1% 24H

Risk Score

4.8 / 10

Balanced

Market heatmap

Live Market Pulse

Unified feed combining pricing, on-chain flows, and derivatives data with AI trend scoring.

Portfolio Intelligence

Multi-exchange holdings, risk bands, and scenario impact analysis in one workspace.

Signal Studio

Curated signals with confidence bands, timeframe filters, and execution-ready summaries.

Custom Dashboards

Drag-and-drop widgets for traders, allocators, and research teams.

Market overview

Top assets by flow, volume, and AI conviction.

Strategy performance

Momentum Basket

Outperforming

+12.4%

Market Neutral

Stable

+4.1%

Yield Rotation

Improving

+6.8%

Active alerts

Macro liquidity rotation accelerates

AI models detect a 14% rise in stablecoin inflows across tier-one exchanges.

Layer-2 adoption trending higher

Gas savings and bridge activity continue to outpace mainnet transfers.

Options market skew normalizing

30D put/call ratios compress, suggesting reduced downside hedging.

Institutional-grade security & governance

Built with audit-ready logging, granular permissions, and compliance reporting across every workflow.

Permissions

12 profiles

Audit Events

98,000/day

Risk Rules

140 active

Compliance Reports

Daily / Weekly

Ready to activate your trading desk?

Access unified analytics, AI signals, and execution controls from the EAI web platform.